Chart of Accounts advanced topics

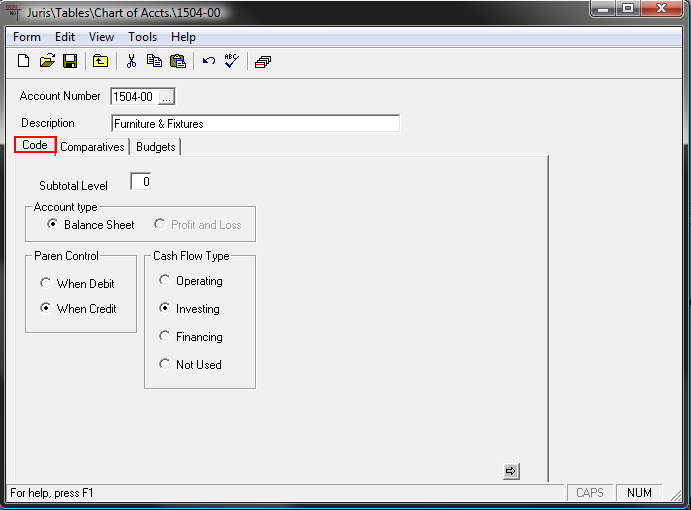

Code tab

Subtotal level [0-9]

Use this field to group accounts on the General Ledger Trial Balance and General Ledger Report for Juris Core and Juris Suite. This field does not affect the financial statements for Juris Core and Juris Suite. For more information on financial statements, see Financial Statement overview.

Account type [Balance Sheet or Profit and Loss]

Asset accounts, liability accounts and owner's equity accounts are Balance Sheet accounts. Expense accounts and income accounts are Profit and Loss accounts. Typically a number range will be established for each type of account. For example the range from 0001 to 4999 might be used for Balance Sheet accounts while the range from 5000 to 9999 is used for Profit and Loss Accounts.

Juris will attempt to determine this range based on items entered and will default the Account Type based on the range detected by the system. For example, if the account number 3000 is the first P&L account entered, then when an account greater than 3000 is entered, Juris will automatically set it as a P&L account. The default account type may be changed by the user.

Note

If accounts are entered randomly with no discernable range defined, the default account type automatically populated by Juris will vary.

Paren control [when debit/when credit]

For asset or expense accounts, a Debit balance is a normal balance. When those accounts have a Credit balance,Paren control (parenthesis control) would be used to indicate that is not a normal balance for that type of account. Therefore, asset and expense accounts are typically created with Paren control set to "When Credit" and the amounts would be shown in parenthesis when the balance is a credit balance.

For liabilities, owner's equity or income accounts, a Credit balance is a normal balance. When these accounts have a Debit balance, Paren control would be used to indicate that is not a normal balance for that type of account. Therefore, liability, owner's equity or income accounts are typically created with Paren control set to "When Debit."

Cash flow type

- Operating

- Investing

- Financing

- Not used

Defining the type of cash flow of particular accounts is optional (can be set to 'Not Used').

Tip

When cash flow types are established, monitoring and projection of cash flows by type can be achieved.

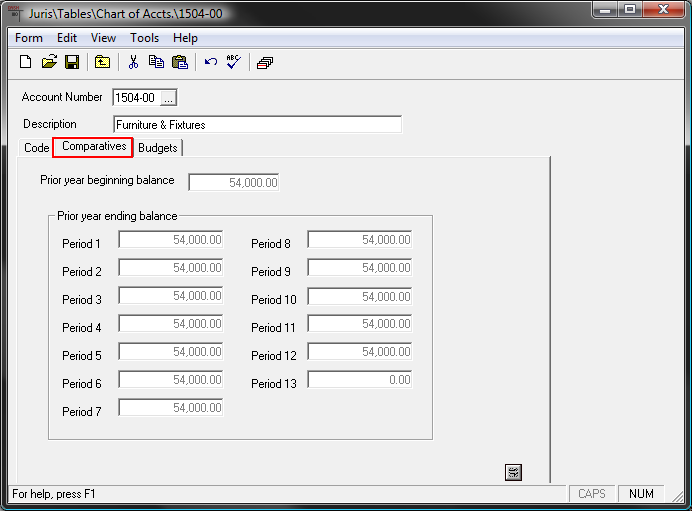

Comparatives

Prior year beginning balance

This field will show the beginning balance for this account from the prior year based on prior year activity for that account. The amount will be determined when Close Accounting Year for the prior year is performed. This value will be blank until the first accounting year has been closed.

Prior year ending balance (Period 1 - 13)

These fields will be populated based on prior year activity for each period. The number of periods used will be based on the accounting periods as determined by the setting made in Firm Options. See Accounting Periods for more details.

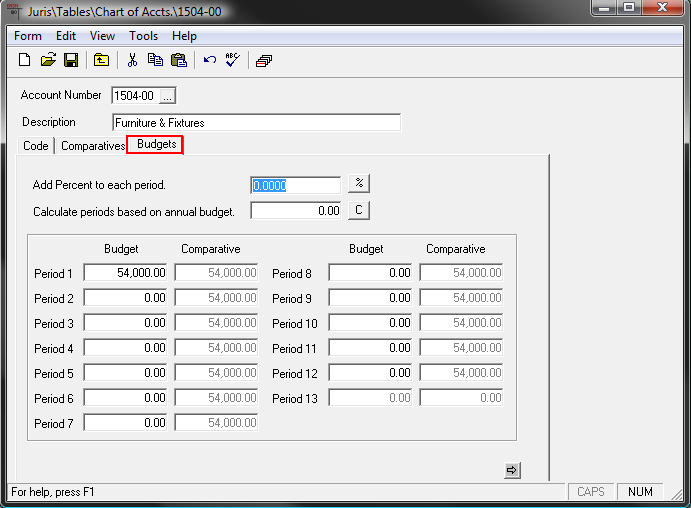

Budgets

Add percent to each period

A Percentage value can be entered and when the percent button is selected

![]() Juris will calculate that percentage of the budgeted amount

for each period and will increase the budgeted amount for each period

by that percent.

Juris will calculate that percentage of the budgeted amount

for each period and will increase the budgeted amount for each period

by that percent.

Calculate periods based on annual budget

An annual

budgeted amount can be entered here and when the calculate button is selected

![]() Juris will calculate

the budgeted amount for each period by dividing the annual amount by the

number of periods.

Juris will calculate

the budgeted amount for each period by dividing the annual amount by the

number of periods.

Period 1 - 13: Budgets and comparatives

The Comparative figures come from the prior year comparatives for each period. The budgeted amounts may be calculated based on the Annual budget, or they may be typed in manually. Once values are entered in these fields, the "Add Percent..." option can be used to increase the budgeted amounts by a certain percentage. The number of periods used will be based on the accounting periods as determined by the setting made in Firm Options. See Accounting Periods for more details.