Set Retained Earnings

The Set Retained Earnings function will be performed only once to establish and set the Retained Earnings Account and to close the oldest accounting year.

Note

The Close Accounting Year function will not be enabled if the Set Retained Earnings function was never performed.

Caution

Juris recommends that a backup of your database be made prior to running Set Retained Earnings. Once the Set Retained Earnings function has been saved, it cannot be undone except by restoring from a backup.

Have all users exit the program, and place Juris in Maintenance Mode to assure that no users log in until this procedure is complete. Juris recommends that a backup is performed prior to setting retained earnings. Once the Set Retained Earnings function has been completed, it cannot be undone except by restoring from a backup.

-

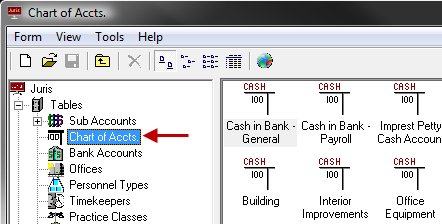

Open Juris > Tables > Chart of Accounts.

-

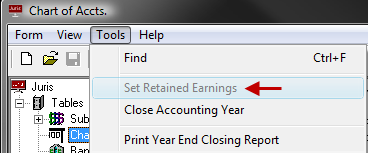

Select Tools > Set Retained Earnings.

- Enter or select the main Retained Earnings Account. The Sub Accounts, Sub Accounts Description, Ending Balance and Profit for the accounting year being closed will be displayed for each Sub Accounts.

-

The firm has the option to Set Retained Earnings by Sub Accounts. This option is only enabled if Sub Accounts have been defined in Sub Accounts.

Note

In order to use this option, a Retained Earnings Account with the same base account number as the main retained earning account selected in Step 4 must be created for each b. If multiple Sub Accounts have been defined, but the option to Set Retained Earnings by Sub Accounts is not selected, the profits for each ProfitCenter are posted to the main Retained Earnings Account.

- Click Calculate Retained Earnings Now, and the Beginning Balance(s) for Sub Accounts(s) for the new accounting year will be displayed.

-

Review the displayed information and if it is not correct, close the Set Retained Earnings form without saving your changes. Make the required adjustments and then return to the Set Retained Earnings form and repeat the steps above. If the information displayed is correct, click on the Save button or select Save from the Form Menu to Set Retained Earnings and close the prior Accounting Year.

- Placed in Normal Mode and users may be allowed to return to the system.