Create a new Expense Code

To create a new Expense Code:

-

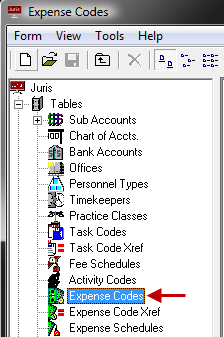

Select Tables > Expense Codes.

The Juris\Tables\Expense Codes window opens.

-

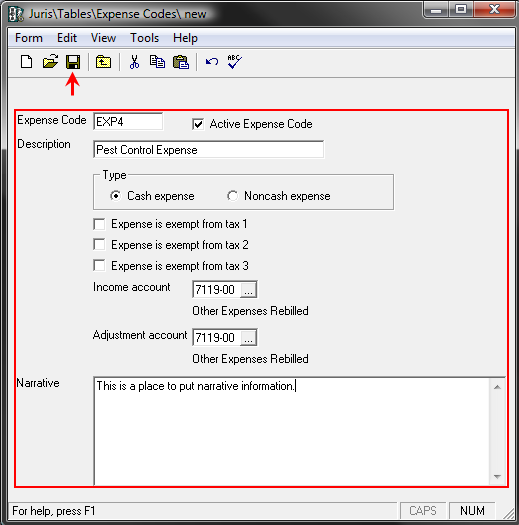

Click the New icon on the toolbar to open the Juris\Tables\Expense Codes\new window. Note that you can also select Form > New from the menu, or press Ctrl + N on your keyboard.

- Type an Expense Code.

- Type a Description.

-

Select the expense Type, Cash or Noncash..

Note

Once the expense code is saved, the 'Type' may only be changed when the following conditions exist:Juris is in Maintenance Mode or No open prebills exist that have expenses that use that expense code.

- If the expense is exempt from Tax 1, Tax 2, and/or Tax 3, click on the appropriate check box to place a check mark in it. A check mark indicates that the expense is not taxable (i.e., tax exempt).

- For Cash expenses, an Income and Adjustment account must be chosen, for Noncash expenses , an Income account must be chosen.

-

Type a Narrative for the Expense Code.

When the expense code is used, the narrative entered here is placed in the Expense Entry Narrative.

- Click the Spell Check icon on the toolbar to spell-check the form. Note that you can also select Form > Spelling from the menu, or press F7 on your keyboard.

-

Click the Save icon on the toolbar to save the schedule. Note that you can also select Form > Save from the menu, or press Ctrl + S on your keyboard.

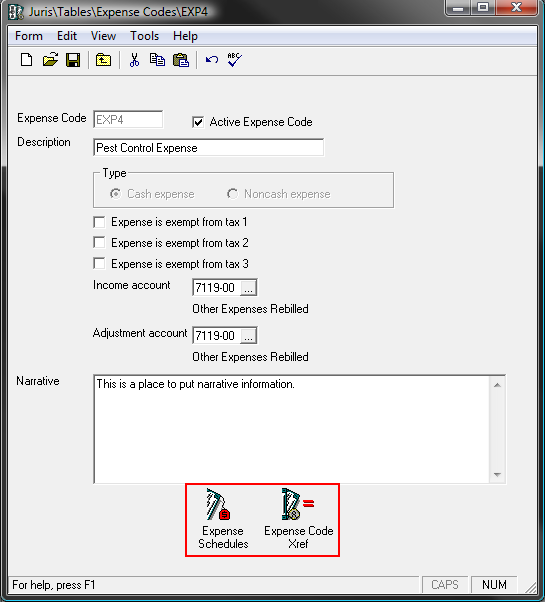

Once saved, the Expense Schedules and Expense Code Xref Schedule icon appears.

- Click the icon to open the ExpenseSchedule and review the form.

- The ExpenseCode is added to the Standard Expense Schedule by default. The code may also be added to other expense schedules, if desired. See Expense Schedules for details on this item.

- Click the icon to open the Expense Code Xref and review the form.

- See Expense Code Xref for details on this item.