FeeJE Tab

Note

Remember to click the 'Save' icon to commit the changes.

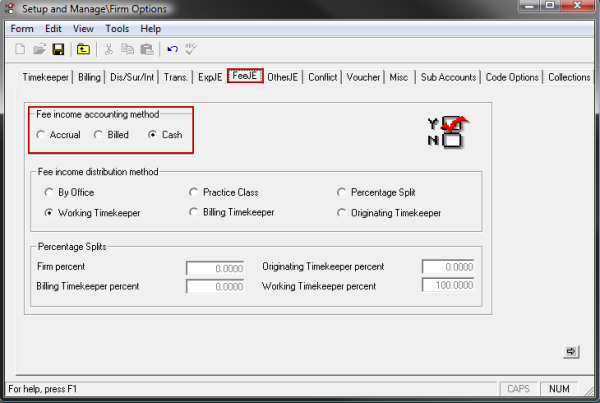

Fee income accounting method.

Accrual Accounting, Billed Accounting or Cash Accounting method may be selected for Fees (this method will also be used for noncash expenses).

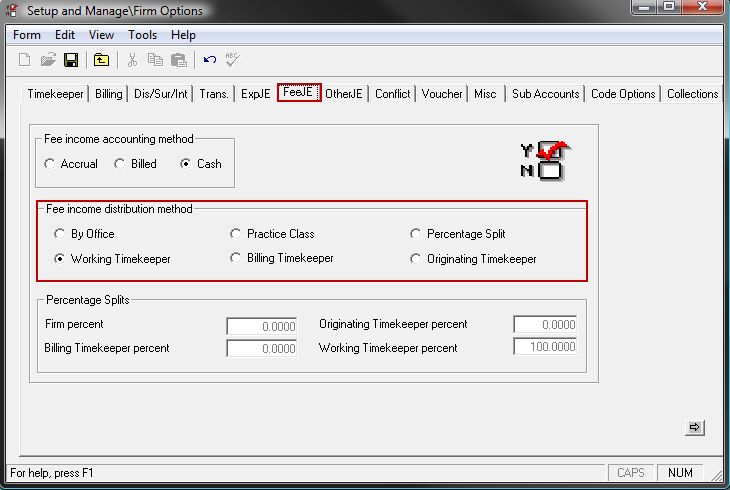

Fee income distribution method.

Fees may be distributed by Office, Practice Class, Percentage Split, Working Timekeeper, Billing Timekeeper or Originating Timekeeper. If Percentage Split is selected,then further options information must be supplied (see Percentage Splits item below). The setting made here will determine the G/L accounts used when expense transactions are processed. See Figure 2.0

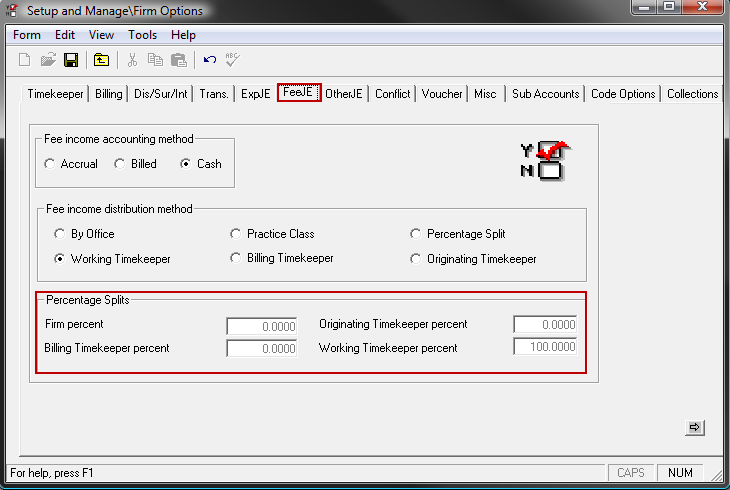

Percentage splits.

If the Percentage Split option is selected for the fee income distribution method, then the fees may be split between the Firm, the OriginatingTimekeeper, the Billing Timekeeper and/or the Working Timekeeper. The G/L accounts for each of these items would be used to process their respective percentage of the fees. See Figure 3.0