Unpost a bill

When a bill is accidentally posted , or a bill must be unposted in order to re-select it, you can use the Unpost bill feature to unpost the bill. Note that once a bill is unposted, a new prebill must be generated and all edits made to the original bill are lost.

Caution

Unposting cannot be reversed, it can only be undone by re-billing exactly as originally billed.

Note

If a bill has a Cash Receipt or Credit Memo applied to the A/R balance, you cannot unpost without reversing those transactions. Attempts to unpost produce the error "Bill cannot be unposted because a cash receipt, credit memo, or trust adjustment has been applied to the bill".

To unpost a bill:

- Start Juris and log in, to open the main Juris window.

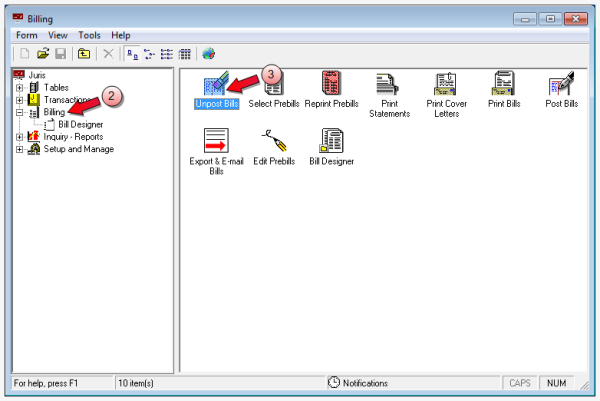

- Double-click Billing.

-

Double-click Unpost Bills.

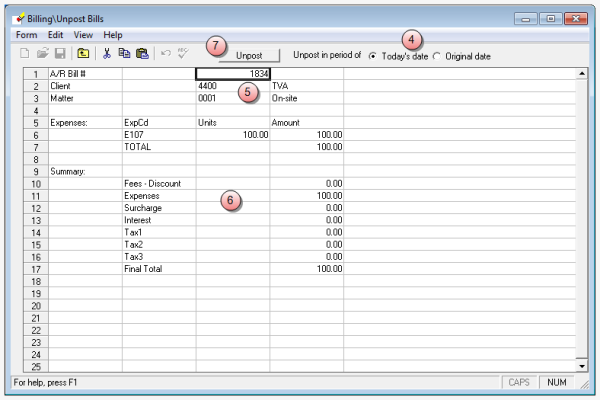

The Billing\Unpost Bills window opens.

-

Select a Unpost in period of option:

- Today's Date - un-posts the bill on today's date, in the current period.

- Original Period - un-posts the bill on the same date, and in the same period as the original bill.In the

-

In the A/R Bill # row, type the bill (invoice) number of the bill you need to un-post, and press the Tab key.

Note

Manual Bills and bills that have Cash receipts, Credit Memos and Trust Adjustments applied cannot be unposted.

- Review the bill to ensure that you have selected the bill you need to un-post.

-

Click Unpost.

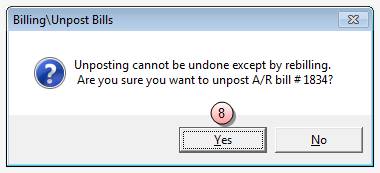

You are asked to confirm your action.

-

Click Yes, to un-post.

You are returned to Billing\Unpost bills window

- Click the window Close button to close the User IDs\[user id] window.

Consolidated bill tips

- PPD can be transferred in edit prebill on consolidations.

- Fees or expenses can be held on a matter that is on a consolidated bill

Split bill tips

-

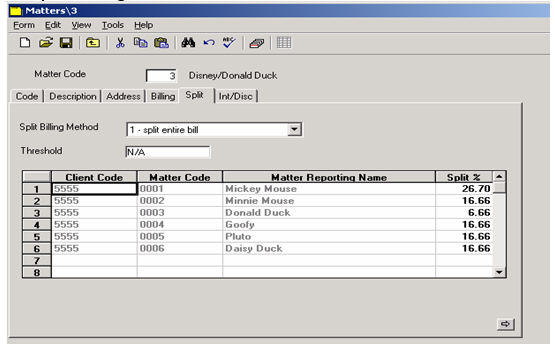

A matter can be split with as many matters as desired as long as the percentage totals 100.

- When selecting prebills, you only need to select the client/matter the bill is to be split from.

-

When applying cash to a split bill, you must apply the cash to each of the matters to which the bill was split. The bill number is the same for each of the matters.

Note

We advice not using the wizard on a split bill, because it does not know how you want the cash to be split.

- A split bill includes fees, expenses, interest, taxes and surcharges.

- A bill can be split over a threshold (for example, if you set a threshold of $500, it will split the bill if the total amount on the bill on the ‘split from’ matter reaches $500).

- If you unpost a split bill, it un-posts the bill across the board, meaning that the ‘unpost’ appears on both the split from and the split to.

Discounts

Normally discounts apply to fees but can be applied to a % of the bill (this is set up under the matter).

What happens if the discount applied is greater than the fees billed?

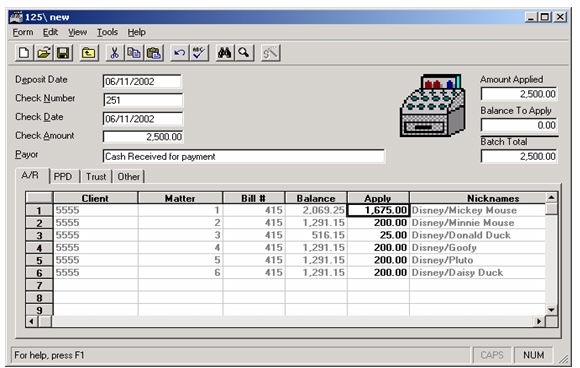

Example bill where Discount > Fees Billed

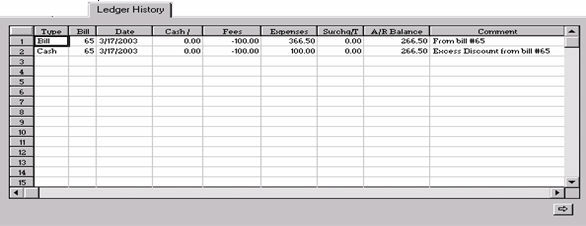

Example of the Ledger History

For Bill #65 a –$100.00 fee entry was made because the original amount of fees was only $400.00. Since the discount was in the amount of $500.00 the process tries to apply the full amount of the discount to fees first. Then a -$100.00 cash entry was made to balance the negative fee entry. Next a +$100.00 (the remaining $$ of the $500.00 discount) was applied to Expenses. Note the comments line.