Verify the 1099 Status of a Vendor

There may be times when you need to find out whether or not a vendor receives a 1099 at the end of the year. For example, when you refund trust, you need to check the vendor's 1099 status to ensure that a trust refund is not going to be reported on a Form 1099 at the end of the year.

Take the following steps to check whether or not a vendor receives a 1099:

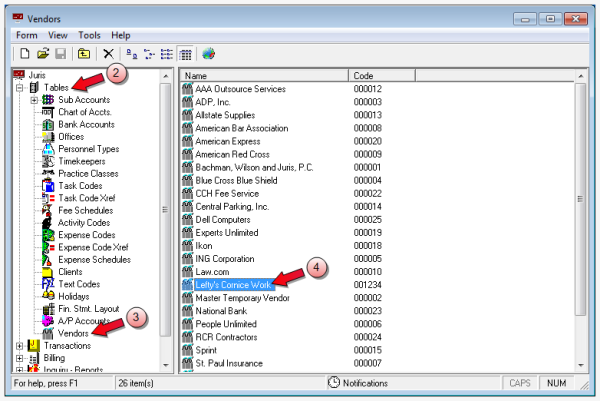

- Start Juris and log in to open the main Juris window.

- Double-click Tables to expand the folder.

- Double-click Vendors to expand the folder.

-

Double-click the icon or description for the vendor.

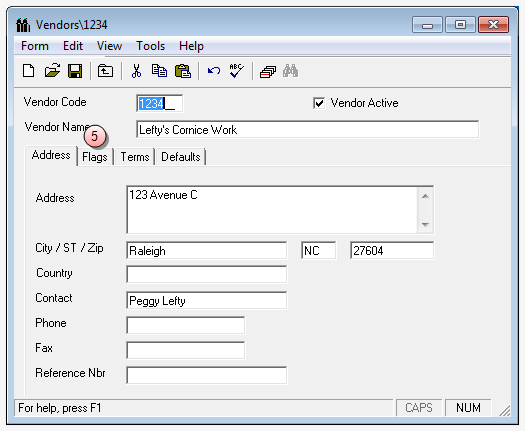

The Vendors window opens, displaying the information for the vendor you selected.

-

Click the Flags tab.

-

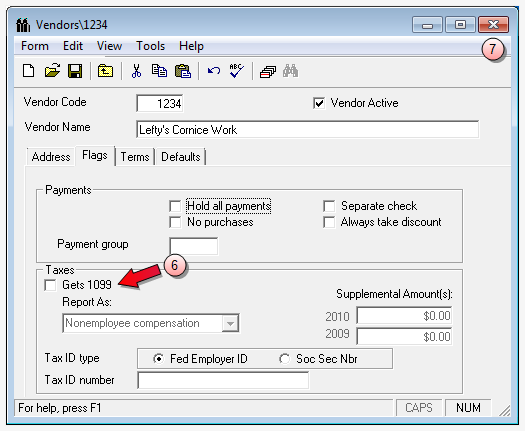

Verify that the status of the Gets 1099 check box is correct:

- If the check box is "selected" (checked), it indicates that the vendor has been setup to receive a 1099.

- If the check box is "not selected" (not checked), it indicates that the vendor has not been setup to receive a 1099.

- Click the window Close button to close the Vendors window.